Public Adjusters for Hail Damage Fighting for the Payout You Deserve

Storms Hit Fast. Compensation Should Too.

When hail strikes, the damage is not always obvious at first—but the consequences can be severe. From cracked shingles and bruised underlayment to leaks forming weeks later, the need for a public adjuster for hail damage claim becomes clear. Too often, homeowners looking for help with hail insurance claim face roadblocks, slow communication, or lowball offers. Even worse, many get a hail damage insurance claim denied outright because the adjuster called it “cosmetic” or “pre-existing.” Fisher Public Adjusters understands the tricks insurers use. Whether you are looking for hail roof damage claim assistance or searching for a hail damage public adjuster near me, our team responds quickly, documents damage thoroughly, and fights for what you are owed. We advocate for full repair, not partial patchwork, and make sure your home gets the restoration it deserves.

Insurance Companies Have Their Team—You Deserve One Too

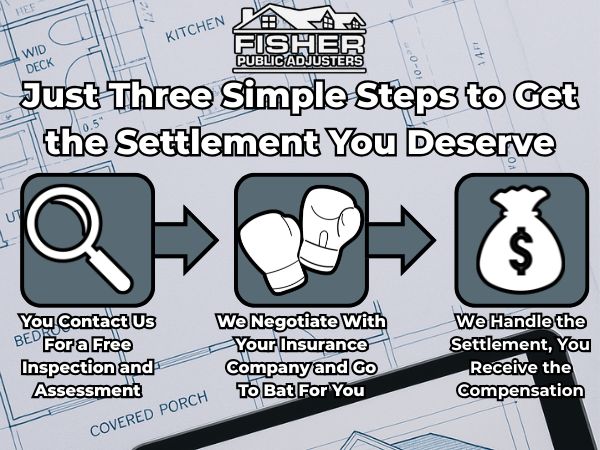

If your property was damaged in a recent hailstorm, you may already be receiving calls, emails, or adjuster visits—most of them favoring the insurer. That is why it is critical to have a public adjuster for hail damage claim in your corner from the beginning. We provide real help with hail insurance claim navigation, especially when policies get murky about cosmetic versus structural loss. If you are feeling overwhelmed or suspect your estimate is too low, we will walk you through everything. As a local and family-owned team, we go to bat for homeowners—not big carriers. From start to finish, we ensure nothing is missed, and no one is taken advantage of. When you need hail damage public adjuster near me services, Fisher Public Adjusters is ready to stand beside you and demand fairness.

Do Not Let a Denied Claim Decide Your Future

Insurance companies deny hail claims for dozens of reasons—most of them built into vague wording and loopholes. If you received a hail damage insurance claim denied letter, do not assume you are out of options. Many initial assessments overlook flashing damage, attic moisture, or full replacement needs. Our role as a public adjuster for wind damage (in this context referring to wind-hail combinations) is to dig deeper, using drone inspection, infrared scanning, and manufacturer guidelines to support your case. We know how to appeal denials, reopen claims, and present evidence that meets insurer thresholds. If your home has visible or hidden storm impact, we are here to document every inch of it and make sure your claim does not end with a technicality.

We Protect Your Home From the Insurer’s Excuses

Every claim starts with a question: “What will they cover?” Too often, insurers are quick to minimize, stall, or misclassify hail damage. That is why hiring a public adjuster for hail damage claim can shift the entire process. Our experience working with complex policies and building material reports gives us the upper hand. From the very first inspection to your final payout, we push back when adjusters undervalue damage. Whether you need help with hail insurance claim prep, or you are frustrated with unreturned phone calls, our team takes over and demands clarity. We also provide fast, in-person service if you are searching for hail damage public adjuster near me in the Quad Cities or surrounding areas. Let us level the playing field and ensure your claim is treated with respect.

Denied Claims Are Not the End—They Are Where We Begin

A hail damage insurance claim denied outcome does not mean the damage does not exist. It simply means your insurer is betting you will give up. At Fisher Public Adjusters, we see this tactic constantly—and we are here to push back. If you need hail roof damage claim assistance, we will re-inspect, re-document, and resubmit with the correct evidence. Our team also works closely with building code experts and roofing professionals to ensure your damages meet coverage criteria. When you need someone who will not let “no” be the last word, we are ready to fight. If you are looking for a hail damage public adjuster near me, click below to schedule a consultation today. The storm already did enough damage—your insurance company should not add to it.